Understanding Dividends

March 23, 2016

During my experience as a senior registered representative, I found that a surprising number of investors lacked a basic knowledge regarding the nature of stock dividends. This knowledge gap contributes to a perpetual misunderstanding regarding security performance. I trust that filling this knowledge gap will help foster an understanding of where dividends fit in an overall portfolio strategy.

In this article, we focus on plain-vanilla, regular (recurring) cash dividends paid by U.S. companies to common stock shareholders. We want to understand:

- Where dividends come from and why this matters

- Why companies issue dividends

- How stock price and performance are affected

- How dividends are taxed

- Whether you should own dividend paying securities

Where Do Dividends Come From And Why Does It Matter?

Dividends are paid out from residual earnings or reserves left to shareholders after paying expenses and debtors. Dividends are paid out from the company’s cash reserves, thus reducing the total asset value of the company and consequently, shareholder equity.

“Dividends are not free money. This may sound trivial, but it is pivotal to understanding dividends.”

Imagine you have $20 dollars in your right pocket. Now, take $1 out and move it into your left pocket. You still have the same $20 on you…well, almost the same as we will see later.

Why Do Companies Issue Dividends?

In any given year, a company has at least three basic choices for putting its earnings to use. Companies often will use a combination of methods, typically the first two.

- Retain, or reinvest the earnings back into its business operations

- Pay the earnings to its shareholders in the form of a dividend

- Repurchase outstanding shares of its common stock

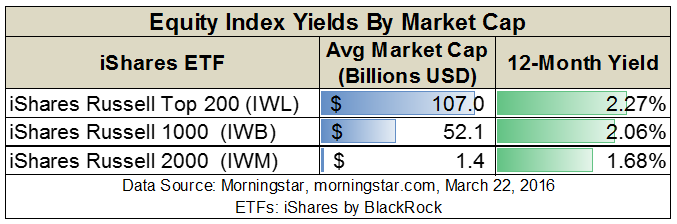

The primary consideration is whether a company has prospects for growth. Can the company use its profits to earn a return1 that promotes growth for its shareholders? If not, then earnings may be returned to shareholders so they can put them to better use elsewhere. Generally, larger, more mature companies tend to pay a higher dividend yield than smaller fast-growing companies as illustrated in figure-1.

Dividends are not like interest payments promised by a bond indenture. The board of directors votes on dividend payments and announces their decision quarterly. A company can increase, reduce, or even cut its dividend altogether.

“What does Warren Buffet say about paying dividends? I recommend reading his 2012 letter to shareholders.”

Board members are considered the ultimate insider. Therefore, dividend policy is often perceived by investors as a signal regarding a company’s real short and long-term prospects. Increasing dividends may signal to some that the company is growing. Others might interpret this as a sign that the company is experiencing increasing difficulty finding new growth opportunities.

What does Warren Buffet say about paying dividends? I recommend reading his 2012 letter to shareholders dated March 1, 2013 starting on page 19. For confirmation, check the dividend yield2 on Berkshire Hathaway Inc., class-A or B-shares.

How Do Dividend Distributions Affect Stock Price and Performance?

At some point after the dividend is announced and before it is payed, the company’s stock will trade “ex-dividend” or without dividend. On that day, buyers will no longer carry the right to this pending dividend. Therefore, it is subtracted from the previous day’s close. This is the second critical point I want to make.

“Before the market opens on ex-dividend, the prior day’s closing price quote is reduced by the amount of the dividend per share. This adjusted closing price becomes the basis for reporting the day’s change.”

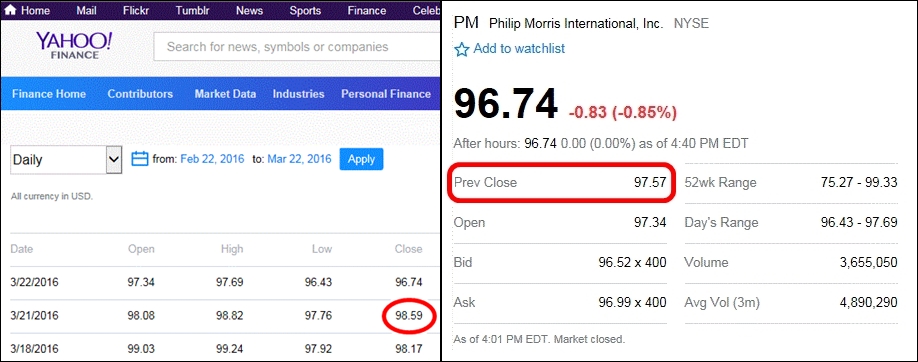

Consider the quotes from Yahoo Finance for Philip Morris (NYSE:PM) in figure-2. The price table on the left shows that PM closed at $98.59 on March 21. The following day PM trades ex-dividend with $1.02 payable. The previous day’s closing price was adjusted down $1.02 to $97.57, which became the basis for reporting the day’s change. Had the previous close been left unadjusted at $98.59, PM would be quoting down $1.85 or 1.88%. Since it was trading ex-$1.02, the quote shows PM down $0.83 on the basis of a $97.57 closing price.

This closing price adjustment can be seen when comparing price charts of PM side-by-side. In price return chart, prices are not adjusted for dividends. In the total return chart, all prices preceding the ex-dividend date are adjusted. Investors must be mindful of selecting the right kind of chart for their particular analysis.

Furthermore, on ex-dividend the price of certain open orders left on the books from the prior day are also adjusted such as sell-stop and buy-limit orders, provided they are not designated “do not reduce”. Consider this text from the FINRA Manual, section 5330, “Adjustment of Orders”.

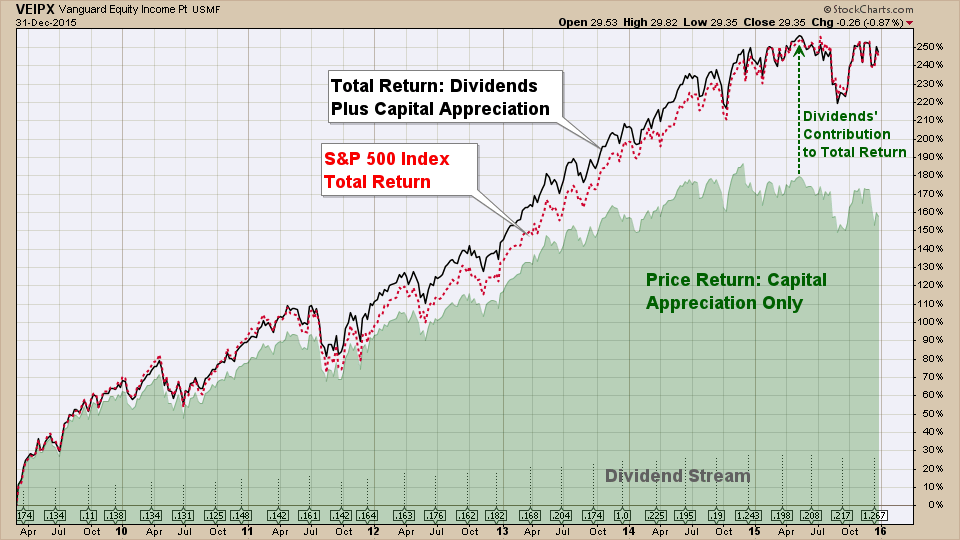

Performance reports by individual security will typically denote only the price change, ignoring the dividend stream. In the industry this is known as “price return”. In contrast, account level performance reports will typically aggregate all sources of gains including dividends for “total return”. One reason returns may be segregated in this way is for tax reporting. Capital gains taxes are applied only to a security’s price return, while its dividend stream is treated as income.

A good example of this phenomenon can be seen in a six-year chart of the Vanguard Equity Income Fund, symbol VEIPX. The green area on the chart represents its price return while the black line represents total return. The red line is the S&P 500 Total Return Index provided for reference (this index is theoretical and incurs no expenses whether management, transactional, or otherwise).

How Are Dividends Taxed?

Let’s return to our illustration of having $20 in your pocket. When $1 moves out of one pocket, the IRS will want it’s cut. I fact, the IRS has its hands in both pockets! In the U.S. we have quite a racket going on with our double taxation system.

The U.S. Government taxes the same dividend twice, first when it is earned by the corporation, and again when received by investors. And if your state feels left out, the dividend is taxed a third time. So, after our fictional dollar moves from your right pocket to your left, your pants might be feeling a little lighter.

“Would it not make more sense to invest in a company that retains its earnings in the first place?”

What if one reinvests the dividend back into the same company and buy more shares? Sorry! Dividends are taxed whether you take them as cash or reinvest them3 through your broker or by enrolling in “DRIPs”. Does this scenario make sense to you? Company profits are taxed, then paid out as a dividend which is taxed again, only to be reinvested back into the company where it all started. What?

Look, I was there when the CFA Institute taught compounding 101. However, would it not make more sense to invest in a company that retains its earnings in the first place because it has wonderful growth opportunities ahead? Just a thought.

Should You Own Dividend Paying Securities?

The answer depends on several factors starting with whether you need the income in the first place. A retired investor may have a preference for higher income, and therefore dividends. A worker with a longer time horizon and sufficient salary may prefer little to no dividends. Then consider your specific tax implications and other factors.

“You can make your own dividend by selling shares.”

It’s worth mentioning the “home-made dividend”, or what Buffet described as the “sell-off scenario” in his aforementioned letter. You can make your own dividend by selling shares. Capital gains taxes are not paid until you sell, and then only on the gains, not the whole amount of the dividend.

You have control over the timing and the amount of distributions rather than accepting what the corporation determines is right for all shareholders. There are transaction fees when selling securities, while there is no fee for receiving a dividend (except costs companies incur distributing dividends). Transaction fees can be minimized by taking larger, less frequent distributions.

Dividends From A Portfolio Management Perspective

I look at the dividend question from the viewpoint of optimizing risk adjusted return. At Coherent, we performed our own in-depth study4 of the behavior of higher dividend paying stocks. Comparing returns in up and down markets, we have found that holding some dividend-focused funds can beneficially reduce volatility. Ultimately this depends on the kind of market we are in, and how other asset classes are behaving.

What Have We Learned About Dividends?

- Dividends are not free money. They are paid from cash reserves, reducing shareholder equity.

- Dividends can be interpreted by investors as a company sharing its growth, or as one having difficulty finding growth opportunities.

- The prior day’s closing price quote is reduced by the amount of the dividend on the day a company trades ex-dividend.

- Individual security performance is typically reported as “price return”, excluding its dividend stream.

- Overall account level performance is typically reported as “total return”, aggregating all sources of return including dividends.

- Dividends are taxed as income in the year they are received. Corporation that issue them are also taxed, a form of double taxation.

- Dividends are a form of income for those who require it. Dividend paying securities can offer higher risk-adjusted returns in a carefully diversified portfolio.

Please feel free to contact us at Coherent if you would like to discuss your specific views on the role of dividends in your portfolio.

Warm regards,

Sargon Zia, CFA

March 23, 2016

You are welcome to comment!

Footnotes:

- More technically speaking, to generate growth for equity owners the company must generate a return that exceeds its cost of equity capital. The projects on which it spends earnings must have a positive net present value.

- Zero as of this writing.

- IRS Publication 17, https://www.irs.gov/publications/p17/, paragraph titled “Dividends Used to Buy More Stock.”

- Study used the S&P 500 Index weekly data as a signal to segregate up and down-trends of more than 10% swings lasting at least 10-weeks. The period covered from 1989 through 2015. Trends were used to generate return comparisons during up-trends, down-trends, and all-trends. Vanguard’s VEIPX was used as the proxy for a dividend-focused portfolio.

CONTACT US FOR A COMPLIMENTARY CALL

We look forward to discussing your unique financial goals and personal values!

GET STARTED

Print PDF

Print PDF