Fed Worries

April 5, 2016

Since the post-Greenspan Fed declared glasnost, studying Fed speeches has become more gratifying and educational. I want to focus on the speech given at the Economic Club of New York on March 29th by the Chair of the Board of Governors of the Federal Reserve System, Janet Yellen1. I believe it sets the tone for the rest of this year if not the decade.

Some Background

In December 2015, The Fed2 raised the federal funds target rate by 0.25% to between 0.25% and 0.50%. This target rate had been near zero for an unprecedented seven years as part of the Fed’s effort to “support the recovery from the worst financial crisis and recession since the Great Depression.”

The Fed stood pat in January and March noting that the market acted pre-emptively in anticipation of the FOMC. “Investors responded to those developments by marking down their expectations for the future path of the federal funds rate, thereby putting downward pressure on longer-term interest rates and cushioning the adverse effects on economic activity.”

Developments since December 2015 have made The Fed worried enough to delay raising the target rate. In this article, I want to examine the speech and explore:

- What The Fed recognizes as positives about our economy

- Recent developments which have The Fed worried

- Policy adjustments The Fed has made since December

- What this means to us and the market for 2016

In A Sound Bite

In the spirit of providing a sound bite, I submit the following:

“Things are not turning out as rosy as we hoped back when we raised rates in December. We have decided to postpone raising rates for the time being. If things get worse, we are prepared to go back to near zero rates.”

For those who prefer a bit more than a sound bite, I submit the rest of this article.

Positives The Fed Recognizes About Our Economy

The Fed cited two positives about our economy at this time:

- An improving job market

- Moderately expanding consumer spending

Over the past three months the labor market has added an average of 230,000 jobs per month, helping keep the unemployment rate down. Increased incomes and declining oil prices over the past few years have helped expand consumer spending. The housing market has also been improving.

Recent Developments Which Have The Fed Worried

What worries The Fed is reiterated throughout the Chair’s speech, namely slower growth globally. Headwinds include significant changes in oil prices, dollar appreciation, market interest rates, and stock market values. Oh, and one more thing, risks regarding (the lack of) inflation.

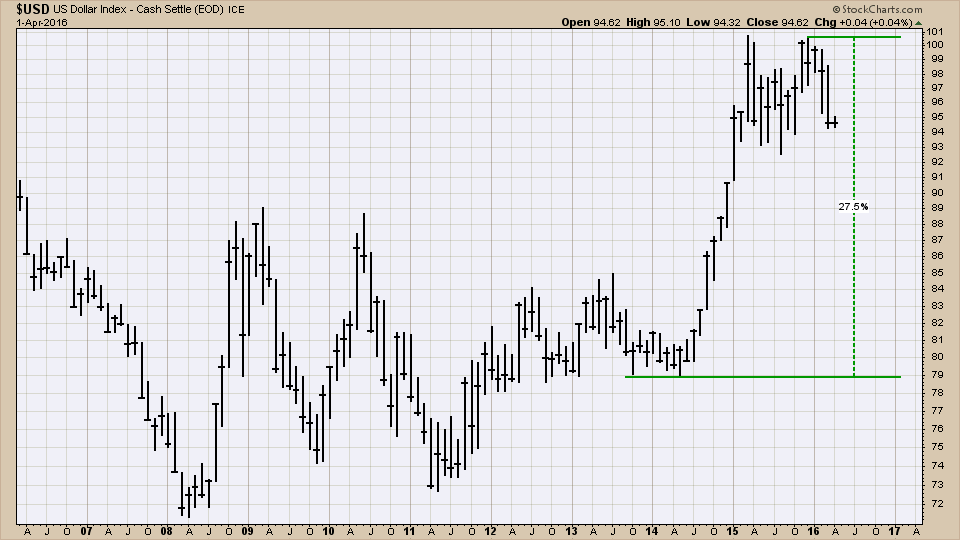

Slow global growth and an appreciating dollar have stifled U.S. manufacturing and net exports. When the currencies of other countries depreciate relative to our dollar, the price of our goods and services rises in terms of their home currency. This has limited U.S. company sales and thus capital spending.

China’s economy is expected to slow in coming years as it transitions from investments to consumption, and from exports to domestic growth. The market’s confusion over China’s exchange rate policy has exacerbated the uncertainty.

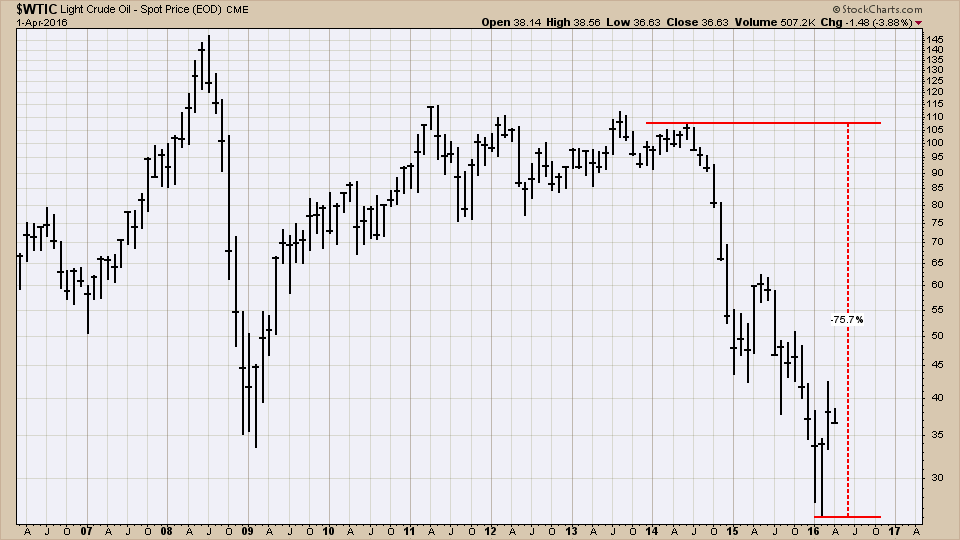

Another worry involves commodity prices, particularly oil. Low oil prices boost spending and growth in the U.S. because we are still a major oil importer. Global markets have reacted negatively over concern that oil prices may be near a tipping point for some countries, and for energy producing firms.

Countries which rely on oil exports can experience sharp cutbacks in government spending. Lower energy costs are good for manufacturing, unless of course you are manufacturing energy. Oil prices have collapsed since mid-2014. If they decline again, companies involved in energy production may see more layoffs.

These risks can mean still slower growth here at home. Higher risk and slower growth spell lower stock prices as investors require a higher return3 for holding risky assets.

Recent market volatility may be signaling more slowing abroad. If accompanied by falling oil prices and a rising dollar, our economy can slow even further, pushing inflation lower. The Chair confesses that continued low readings in some inflation indicators “do concern me.”

Policy Adjustments The Fed Has Made Since December

The Fed has been worried enough to delay raising of the target rate, perhaps even lower it back to zero. The speech focusses on explaining why “The Committee (FOMC) anticipates that only gradual increases in the federal funds rate are likely to be warranted in coming years.”

The Fed estimates that the neutral, real (net of inflation4) federal funds rate which would cause neither expansion or contraction in the economy is now near zero. The current real rate is even lower than this neutral target at negative 1.25%.

Pay special attention to the following statement from the speech.

“If the expansion was to falter or if inflation was to remain stubbornly low, the FOMC would be able to provide only a modest degree of additional stimulus by cutting the federal funds rate back to near zero.”

The Fed doesn’t have much power left to fight low inflation by using either the federal funds rate or more quantitative easing.

What This Means To The Market For 2016

Economic conditions have not improved as one would think considering the recent rebound in stock prices. In fact, The Fed expects growth abroad and earnings expectations to be weaker this year than previously expected. The FOMC hopes that the labor market improves faster to abate current headwinds.

The current expectation is not that the economy will become healthier, but rather less sick. The Chair anticipates growth will be “supported by a lessening of some of the headwinds that continue to restrain the U.S. economy”.

We just concluded a horrible fourth quarter earnings season, the worst of 2015. The market has logged four straight quarters of contracting operating earnings, the worst since 2009. As we begin the first quarter’s earnings season, I suspect the market will be sharply focused on forward looking estimates. Eventually, things will turn around fundamentally.

Warm regards,

Sargon Zia, CFA

April 5, 2016

You are welcome to comment!

Footnotes:

- “The Outlook, Uncertainty, and Monetary Policy”, Chair Janet L. Yellen, March 29, 2016, at the Economic Club of New York, http://www.federalreserve.gov/newsevents/speech/yellen20160329a.htm

- More accurately stated, the target federal funds rate was raised by the Federal Open Market Committee or FOMC, or “the Committee”.

- A rising equity risk premium results in lower stock prices, all else being equal.

- PCE: Personal Consumption Expenditure, an indicator used by the FOMC as a benchmark for inflation.

CONTACT US FOR A COMPLIMENTARY CALL

We look forward to discussing your unique financial goals and personal values!

GET STARTED

Print PDF

Print PDF