Tax Time 2016

February 29, 2016

Whether you prepare your own taxes, or have a tax preparer file for you, tax filing season is a great time to review your overall financial situation. Why now? Because you have all your financial information right in front of you! The goal is to look at taxes over two consecutive years to determine what is the most effective use of various tax strategies. So as you file for 2015, you can start thinking about 2016.

When Is The 2016 Tax Filing Deadline?

For those who prefer waiting as long as possible, the tax filing deadline is a few days later this year! Returns must be filed by April 18th 2016 unless the taxpayer elects to get an extension. It’s important to note that receiving the automatic 6-month extension does NOT extend the timeframe for payment for estimated taxes owed.

Which Tax Form To Be Most Concerned With?

Tax Form 1099-B is used by brokerage firms to report investment transactions to both the taxpayer and the IRS. The IRS compares the brokerage firm filing to the taxpayers filing to determine if there is a discrepancy. Here are some common issues and suggestions on how to deal with Form 1099-B.

These forms are often received late, may be incomplete or subject revision.

- Consider waiting for final tax filing until all information is complete and accurate. The goal is to avoid having to amend a return.

- IRS form 4868 can be used to get an automatic 6-month extension.

If cost basis information is incorrect, your tax return may signal an income reporting discrepancy.

- Review your brokerage statement and look for any “missing” information for the cost basis on each of your investment holdings.

- Pay special attention to investments received as a gift or transferred from a different account for cost basis reporting issues.

Be prudent in checking and correcting your 1099-B.

- First seek to have the issuer of the 1099-B correct the error prior to information being sent to IRS.

-

If your brokerage firm is unable to make the change, beware that if the taxpayer reports the correct number, the IRS system may “red flag” the discrepancy and generate a letter. Discuss with your tax advisor using form 8949 to enter an adjustment to appropriately account for the discrepancy.

What Changes Are There From 2015 Taxes?

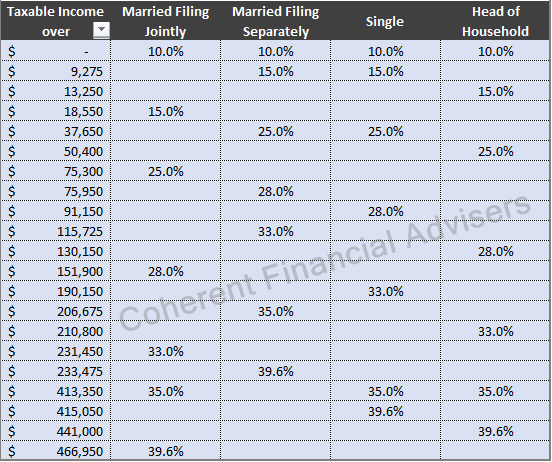

This year, the 2016 income tax brackets are marginally wider than in 2015. The IRS inflation rate adjustment is calculated from September 2014 to August 2015. There are 7 marginal tax brackets, ranging from 10% to 39.6%. Below is the Coherent perspective on the IRS 2016 brackets. Note for instance, you can more easily compare and contrast the marginal tax rate breakpoints for each tax filing status.

Has The Federal Estate Tax Or Gift Tax Changed In 2016?

The Federal estate exemption, also known as the “unified credit” is indexed for inflation. For 2016, the exemption amount has increased slightly from $5,430,000 to $5,450,000. The tax rate remains unchanged at 40%.

The annual gift tax exclusion remains the same at $14,000 per donor to each recipient. For married couples, a gift of $28,000 to any person is allowed without incurring the gift tax. To avoid any confusion, consider the best practice of writing two checks for $14,000 each. Form 709 is the gift tax form needed for larger gifts. Form 709 in an annual return that is due by the April tax filing deadline of the following year.

State Estate Taxes Are Increasing

Some individual states that impose a state estate tax are increasing exemption amounts to correspond with the federal estate tax exemption of $5,450,000 in 2016. Maine, Delaware and Hawaii have state estate tax exemption equal to the federal exemption. Maryland and New York will be gradually increasing their exemption to meet the federal level. Fourteen states currently have an estate tax. Arizona does not currently have an estate tax or impose an inheritance or gift tax.

Interesting Tax Tidbit: Are Moving Expenses Deductible?

There is a three-point test for deductibility of moving expenses.

- The move must be closely related to the inception of the new job.

- The new main work location is at least 50-miles farther from your previous residence than your old work location.

- Time at your new work: Employees must meet the 39-week test while self-employed must meet the 78-week test.

Another factor to consider is that temporary storage for a job related relocation is limited to 30-days of storage expenses. IRS Publication 521 provides more details.

“After you have gathered your tax documents and worked on preparing your taxes, don’t simply file everything away with a big sigh of relief until next tax filing season.”

We look forward to helping you review your financial situation while your information is recent, relevant and readily available. Meanwhile, review our Financial Planning Timeline. As always, feel free to contact us at Coherent.

Best Regards,

Tom Pietrack, CFP®

Director of Financial Planning

February 29, 2016

DISCLAIMER: COHERENT FINANCIAL ADVISERS IS NOT A TAX PREPARER AND DOES NOT DIRECTLY OFFER TAX ADVICE.

CONTACT US FOR A COMPLIMENTARY CALL

We look forward to discussing your unique financial goals and personal values!

GET STARTED

Print PDF

Print PDF