Manager’s Letter 2016 Q3

October 5, 2016

Fifty years ago last month, NBC aired the first episode of Star Trek. In its preceding pilot, “The Cage”, the captain is held prisoner by aliens who have the power to project incredibly lifelike illusions. Concerning the financial markets, people readily create their own illusions without any assistance from aliens. At Coherent, we prefer sound reason over illusion.

Reason Or Illusion?

Earnings estimates are a significant driver of the stock market’s trend. I developed the first chart below to approximate the margins or sales growth needed to produce the market’s estimated operating earnings. As explained in our August Earnings Insight article, this chart helps answer the question, “Are current estimates within the realm of reason?”

For many quarters now, the answer has been – no, not on this planet. For instance, to produce the $29 and $31 operating earnings per share estimated for Q3 and Q4, the S&P would need to generate 9% and 14% sales growth, respectively, at 9.5% margin. This is like Captain Kirk demanding, “I need warp-factor 12 now!” As you Trekkies out there would agree, that’s an illusion not even Scotty can deliver.

“When the market is priced for the worst, it tends to react well to bad news. But when loftier expectations are already priced-in, it can react negatively even to good news.”

Priced For The Worst?

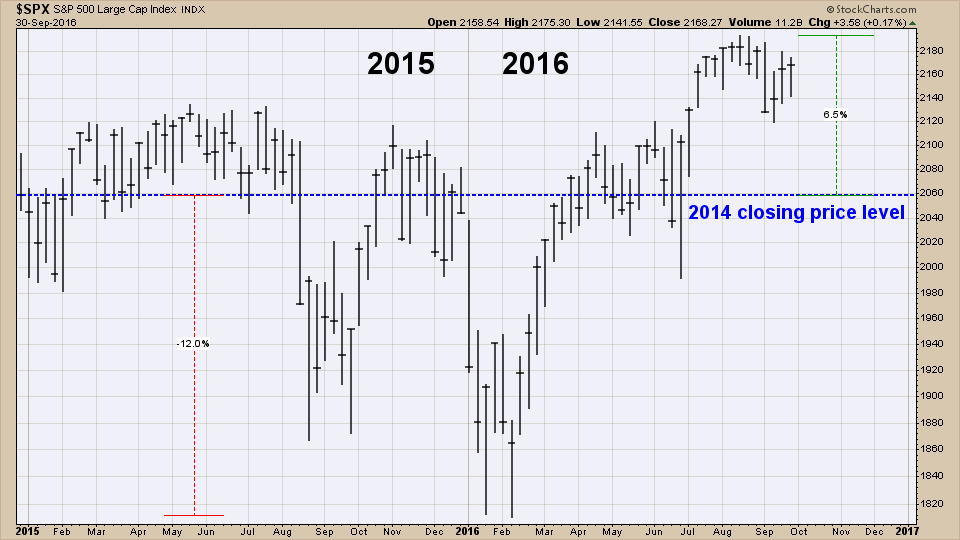

When the market is priced for the worst, it tends to react well to bad news. But when loftier expectations are already priced-in, it can react negatively even to good news. Operating earnings growth from 2015 through 2016 adds up to being flat at best. Meanwhile, the S&P corrected around its 2014 close, albeit at an above-average forward P/E ratio (figure-2). It appears the market is not priced for the worst.

By all accounts, stock market expectations have been excessively optimistic since 2014, as we discussed in our May Earnings Insight article. The wild card is and always will be the P/E ratio. While market fundamentals such as earnings are bounded by the physical laws of nature, what people are willing to pay for them is not.

“While market fundamentals such as earnings are bounded by the physical laws of nature, what people are willing to pay for them is not.”

This Is Not An Illusion!

You and I are paid by market movement, not veracity of opinion. We must therefore consider the market’s current uptrend as I shared in our September Coherent Investor article. Given easy monetary policy and favorable earnings and dividend yields relative to the 10-year bond, it is not unreasonable to fathom the market being driven higher.

Portfolios remain positioned to fully participate should the uptrend resume. The helm is ready for evasive maneuvers when market conditions change.

“Live long and prosper,”

Sargon Zia, CFA

October 5, 2016

You are welcome to comment!

Published quarterly, the Manager’s Letter series primarily communicates the author and Chief Investment Officer’s personal opinion on the markets and other topics of interest to our clients.

CONTACT US FOR A COMPLIMENTARY CALL

We look forward to discussing your unique financial goals and personal values!

GET STARTED

Print PDF

Print PDF